GOP makes a cash grab

in this story

people

topics

Social Security: President Obama should be commended for fighting to include additional Tax Cuts for working Americans during negotiations with congressional Republicans over the approaching expiration of the Bush tax cuts.

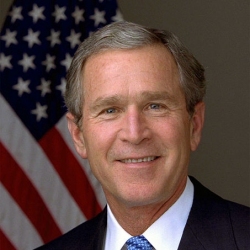

PHOTOS: George W. Bush in pictures

Giving struggling American families extra spending money will provide our economy with a desperately needed boost.

VIDEOS: George W. Bush in videos

Yet, one method by which the Compromise tax bill provides American workers with $120 billion in tax relief reveals an ulterior motive on the part of Republican negotiators. Inste...

related content

Owens op-ed in support of tax-cut compromise

Rep. William L. Owens, D-Plattsburgh, has offered the following editorial about why he will be supporting President Obama's Compromise on the extension of the 2001 and 2003 Tax Cuts when it comes to the House floor for a vote soon.

Like many of my Democratic colleagues, I have long supported making the Bush-era Tax Cuts for the Middle Class permanent while letting the Tax Cuts for the ultra wealthy expire. But unlike many in Washington, I have urged leadership of both parties to Compromise on ...

Sam Seder: I don't trust Obama with my retirement insurance, do you?

Contemplate what this statement means: "Most of our long term Debt and Deficit has to do with Social Security". It's a pretty banal falsehood. Social Security has never contributed a dime to any Deficit or debt. It's fully self-funding and has been for the past 70-plus years. Even in the worst-case scenario, where we don't lift the cap on Payroll taxes, Social Security won't contribute to the Debt or Deficit - it will merely pay 75% of due benefits after the year 2037.

What's truly stunning, a...

Why Ive Changed My Mind About The Obama/Republican Tax Compromise

Five days ago, I tentatively supported the The Obama/Republican Tax Compromise ,

In other words, the choice is to take this deal or let the Bush Tax Cuts expire in the middle of a Recession, when we desperately need to stimulate The Economy. On the merits, it’s far from a perfect deal, but it moves the ball more our way than the Left’s way and I think Republicans in the Senate should take it.

This was never a great deal, but my thinking was that the benefits of stimulating the e...

Prevent Hostage-Taking: Add Debt Ceiling To Tax Deal!

This post originally appeared at Campaign for America's Future (CAF) at their Blog for OurFuture. I am a Fellow with CAF.

If you like your Social Security, Medicare, Medicaid, courts, roads, trains and the rest of what government does for We, the People, then you should pay attention to this. Early next year the Republicans will demand severe cuts to everything or they will allow the country to default on its Debt. They mean it and they are planning for it. The coming "debt ceiling" fight can be...

The plot to destroy Social Security

The nation's largest organization for seniors, AARP, endorsed the Obama Payroll Tax cuts. The organization did this despite the fact that the Obama Compromise offers little in the way of benefits for seniors.

The allegedly liberal publication, Mother Jones, just ran a piece by Obama apologist Kevin Drum claiming that there's every reason to believe that the Payroll Tax holiday will be over in just one year as promised in this deal. It's another example of tortured logic listing Republican avar...

The Insider: Speier rips Obama, tax cut deal

Rep. Jackie Speier on Friday lambasted the Tax Cut deal President Barack Obama reached with Republicans this week, vowing not to support it unless key provisions are changed, and she questioned the president's political values. Speier said the package doesn't do enough to stimulate The Economy, gives away far too much to the rich and threatens the existence of Social Security. "It's more than TARP, it's more than the stimulus, it's more than any of the interventions we have undertaken (to spur ...

Moodys Raises Specter of U.S. Downgrade After Tax Cut Deal

Pragmatism!

Moody’s Investors Service, a leading credit Rating Agency, warned in a report on Monday that the Tax Cut Compromise could imperil the U.S. government’s top Aaa rating, though a downgrade remains highly unlikely.

The Moody’s report pointed to provisions such as a temporary Payroll Tax holiday and extensions of Unemployment Insurance and the Bush-era tax cuts as likely to produce “substantially higher Budget Deficits,” even Accounting for an expected boo...

Behind Bill Clinton's smile

You've got to give Barack Obama credit. His learning curve gets steeper and steeper, but he continues to climb.

"I'm going to let him speak very briefly," Obama said Friday before making the fateful decision to allow a smiling Bill Clinton a none-too-brief moment in front of the cameras. He might as well have said, "I'm going to let this Grizzly Bear have just one lick of my Ice Cream cone."

That Clinton is a camera hog, or that he puts the lie to Obama's reputation as the most eloquent Democra...

Barbara Boxer defends her support of tax-cut package

Though many of her fellow Liberals oppose the tax-cut deal negotiated between President Obama and congressional Republicans, Sen. Barbara Boxer (D-Calif.) on Tuesday defended her support of the measure.

"The fact is, this bill will be a help to the Middle Class,'' said Boxer, who, during George W. Bush's presidency, assailed the 2001 and 2003 Tax Cuts as skewed toward the wealthy. She and fellow California Democratic Sen. Dianne Feinstein backed the $858-billion package now before the Senate, e...

Hoyer: Senate tax vote reflects 'urgency' for middle-class cuts

The overwhelming Senate vote to advance President Obama’s tax deal reflects an “urgency” to stop a middle-income tax hike, House Majority Leader Steny Hoyer said Tuesday.

“The vote in the Senate indicates an urgency that is felt by a broad spectrum that middle-income taxes not be increased come Jan. 1,” Hoyer (D-Md.) told reporters at his weekly press briefing. “In order to effect that, you’ve got to pass a bill.”

The tax Compromise that Obama

Payroll tax cut worries Social Security advocates (AP)

WASHINGTON – President Barack Obama's plan to cut Payroll taxes for a year would provide big savings for many workers, but makes Social Security advocates nervous that it could jeopardize the Retirement program's finances.

The plan is part of a package of Tax Cuts and extended Unemployment Benefits that Obama negotiated with Senate Republican leaders. It would cut workers' share of Social Security taxes by nearly one-third for 2011. Workers making $50,000 in wages would get a $1,000 tax ...

Pence Wont Vote for Tax Compromise

Rep. Mike Pence (R., Indiana) just announced that he will not vote for the tax Compromise. Saying that “the American People did not vote for more stimulus,” and higher Deficits and Debt, Pence told Sean Hannity, “I will not vote for this tax deal.” “I’ve no doubt in my mind that the first order of business for the new Congress [if the compromise does not pass] … will be to enact a bill that extends all the current Tax Rates on a permanent basis,&r...;

House Dems Prepare To Fold On Obama Tax Cut Deal

House Democrats are coming to terms with the fact that a Tax Cut Compromise filled with provisions they despise will pass and be signed into law. On Tuesday night they vented their frustrations to their harried leadership in a private Caucus meeting, but emerged acknowledging that they've been boxed effectively in by the White House and GOP.

Tomorrow, after the Senate passes the plan President Obama negotiated with Congressional Republicans, Democratic leaders in the House will present their ...

Obama-Republican Deal Could Mean Tax Hike For One In Three Workers

WASHINGTON - The tax deal reached between President Obama and congressional Republicans could mean a higher tax bill for roughly one in three workers as a result of the Social Security Tax Cut Republicans pushed as a replacement for the current Making Work Pay Tax Credit.

The Making Work Pay credit gives workers up to $400, paid out at 8 percent of income, meaning that anybody making at least $5,000 gets the full amount -- and gets as much as anybody else. Its replacement knocks two percentag...

Romney opposes tax deal, with care

Mitt Romney, in an op-ed whose delay -- the tax deal has been out for a few days now -- reflects the exquisite care he's taken with his position, opposes it:

The deal has several key features. It reduces Payroll taxes, extends Unemployment Benefits and keeps current Tax Rates intact. So far, so good. But intermixed with the benefits are considerable costs of consequence. Given the unambiguous...

Conservatives Against the Tax Cut Deal

There is growing conservative opposition to the Tax Cut deal, to the point that some are speculating the Tea Party will punish Republicans who vote yes. Of the Republican senators who voted against the deal, only George Voinovich has a history of voting against tax cuts. The rest were Conservatives like Tom Coburn and Jim DeMint.

The trouble is the Deficit spending that has been included to win Democratic votes: an unfunded Unemployment extension, an Ethanol boondoggle, and other government go...

Romney comes out against Obama's tax cut deal

Former Massachusetts Gov. Mitt Romney (R) announced on Tuesday that he opposes the Tax Cut deal making its way through Congress.

Romney, one of the top contenders for the 2012 GOP presidential nomination, said that President Obama's deal on tax cuts with congressional Republicans wouldn't add enough certainty to a struggling economy.

"Given the unambiguous message that the American People sent to Washington in November, it is difficult to understand how our political leaders could have reach...

GOP contenders extra careful on tax deal

For a host of Republican presidential hopefuls, the White House-backed Compromise to extend the Bush Tax Cuts presents an unlikely dilemma: How to agree with President Barack Obama.

That unfamiliar struggle unfolded Tuesday on the Senate floor, in media interviews and on newspaper op-ed pages, as the potential Candidates sought to play the angles, with some taking bright-line positions in opposition and others hedging their bets with statements notable for their caution.

Continue Reading

Te...

Weekly Audit: Sanders Filibusters Tax Cuts, Electrifies the Left

Sen. Bernie Sanders (I-VT), a self-described Socialist who caucuses with the Democrats, became a folk hero to Progressives when he took to the floor of the Senate for nearly nine hours on Friday to speak against the plan to extend Tax Cuts for the wealthy in exchange for extending Unemployment Benefits for millions of workers and extending Tax Breaks for the Middle Class.

On the Senate floor, Sanders accused his Republican colleagues of wanting to roll back the New Deal:

And that is, they want...

Franken, Klobuchar back unemployment extension/tax-cut compromise

Supporters of President Obama’s Tax Cut Compromise with GOP Senate leadership defeated a threatened Filibuster by mostly Liberal Democrats through the use of Cloture Monday evening. Minnesota Democratic Sens. Al Franken and Amy Klobuchar were among those voting for cloture. The bill could see an Up or Down vote as soon as today. Klobuchar said she voted to advance the bill because of the middle-class tax cuts contained in it. Franken said he supports the measure reluctantly, citing an exte...

Deficit Fraud Romney: Jobless Benefits Are Too Expensive, But The Bush Tax Cuts Increase Revenue

Yesterday, the Senate approved the tax deal that President Obama negotiated with Congressional Republicans by an 83-15 vote. The Legislation now moves to the House, where Democrats are saying that they might tinker with the Estate Tax cut that Republicans are insisting upon.

But it isn’t only on the left that opposition to the deal exists. A few House Republicans have disparaged the deal for including too few Tax Cuts and too much help for the jobless. In a USA Today op-ed today, former ...

Poll: Strong support for unemployment extension

A new Washington Post/ABC News poll found strong public support for most of the elements of President Obama’s Compromise deal with Republicans that would extend the Bush Tax Cuts and federal Unemployment Benefits — particularly the Unemployment extension, which was favored by more than 2/1 margin. Nearly 70 percent of those asked in a recent poll back a Bipartisan tax Compromise that is set for its first vote Monday afternoon on the Senate floor. Of the four major elements in the pa...

Romney Opposes Tax Cut Deal

Mitt Romney writes:

Death and taxes, it is said, are life’s only two certainties. But in the wake of President Obama’s tax Compromise with congressionalRepublicans, only death retains the status of certainty: The future for taxes has been left up in the air. And uncertainty is not a friend of investment, growth and Job Creation.

The deal has several key features. It reduces Payroll taxes, extends Unemployment Benefits and keeps current Tax Rates intact. So far, so good. But intermi...

Romney: Why tax cut is a bad deal

Death and taxes, it is said, are life's only two certainties. But in the wake of President Obama's tax Compromise with congressional Republicans, only death retains the status of certainty: The future for taxes has been left up in the air. And uncertainty is not a friend of investment, growth and job creation.

The deal has several key features. It reduces Payroll taxes, extends Unemployment Benefits and keeps current Tax Rates intact. So far, so good. But intermixed with the benefits are conside...

California Democrat Garamendi takes on Obama over taxes

WASHINGTON — Barely a year after taking office, California Democratic Rep. John Garamendi is criticizing his party's president in no uncertain terms, accusing him of backing "the fabulously wealthy."

He says President Barack Obama is leading "a foolish war" in Afghanistan.

And he says many House Democrats aren't just frustrated — they're angry — with Obama's latest cooperation with the GOP on a tax plan that would continue across-the-board cuts signed into law by President Ge...

Activity on this story

Post your comment

If you are commenting as a guest, enter your personal information in the form provided. Don't worry, your privacy is safe.

Social Security advocates claim the plan to cut payroll taxes for 2011 could endanger retirement benefits . Bullshit